Our CEO, Pat Bollom, sat down with Chris Mueller, Clearinghouse Business Director at SDS, to discuss some of the solutions that our Smart Data Stream Clearinghouse can provide for both Payers and Providers. You can also watch the video of their discussion here.

Pat: I will start out by asking you what enhancements have we recently implemented to help our vendors integrate with our clearinghouse services?

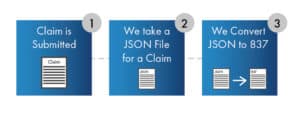

Chris: Yeah, absolutely. For easy integration, we developed JSON objects to help new TPA’s, Payers, and EMR vendors help integrate with our clearinghouse to get outside of the anti-transaction sets. It is a bigger lift for them to implement through the regular 837s and 277 acknowledgments.

We now have JSON objects that they can integrate directly into our platform without having to develop any type of anti-transaction sets. We will take a JSON file for a claim, convert that into an 837, and vice versa for acknowledgments. We’ll take the 277 back in and then convert that to JSON file format and get it out to the submitting parties.

This process helps speed up integration and is native to Java programmers, so it’s easier for them as well.

Pat: Can we receive attachments directly from the Trading Partners or EMR vendors?

Chris: Yeah, absolutely. We presently receive and send out thousands of attachments.

We receive them and send them out. However, what we’re trying to do is help our clients, specifically Payers, that handle a lot of secondary claims that require a primary EOB. So, we have a portal now for Providers to submit claims either through direct data entry, uploading an 837, or another type of proprietary format along with the primary EOB.

We’ll take that primary EOB, convert that into electronic format, embed that data into the 837, which then, in turn, we can send it directly to the Payer, which goes directly to their adjudication platform, eliminating the need for any paper to be received by the TPA or the Payer.

Pat: I want to also ask about what SDS has done to help the travel insurance industry? Because we’re seeing a lot of that, and now with COVID and things opening up, there’s more travel going on.

Chris: We have a lot of clients in that industry where they provide travel insurance for healthcare. Now the issue is if you’re overseas, you’re not going to be sending a standardized claim form on a CMS form or a UB form. So, it’s going to be a non-standard form that we can receive.

We receive the non-standard form on paper. Additionally, our portal has templates for data entry on a non-standard. So, if you’re somewhere in Germany or in Italy or another country, you can go in, you can type in information directly in that customized template, and get that claim information over to us electronically. We can backfill that claim and then send it into the adjudication platform in an 837 or another type of proprietary format.

Pat: A lot was covered, so if you have questions, by all means, reach out. If there’s anything else you’d like to discuss, let us know.