Specializing in technology means working in a field of constant change. Increasingly, healthcare and technology overlap as better processes bring greater benefits to Providers, Payers, and Patients alike.

One of these areas of overlap is claim adjudication. Incrementally adding automation to claims processing, such as upstream data validation and downstream document routing, adds efficiency to turnaround times and aids auto-adjudication rates.

Nearly every organization is seeking to advance using technology in some way. Partnering with a healthcare IT provider is a surefire way to bring clarity to technology upgrades and start seeing the benefits of automation faster.

Table of Contents

Healthcare Claim Adjudication at a Glance

When a healthcare Provider submits a claim to an insurance Payer, the claim undergoes a process called adjudication to inform decision-making and move the claim forward. Healthcare claims adjudication is an important step in accurate medical billing to make sure all parties contribute fairly according to their responsibilities.

Claim Adjudication Definition

Claim adjudication is the process of verifying claim information against the responsible parties to decide whether a claim is paid, reduced, or denied, and then determining the appropriate payment amounts between the Payer, Provider, and Patient.

The typical healthcare claim adjudication process results in one of three outcomes:

- Paid: The claim is approved as is and moves forward in the process.

- Reduced: The claim will be reduced before being processed.

- Denied: The claim is rejected for any number of reasons, often because of inaccurate data.

Manual Adjudication versus Auto-Adjudication

Auto-adjudication applies automation and machine learning to the claims processing workflow with technologies such as SNIP Validation and Optical Character Recognition (OCR) for more accurate data that leads to increased efficiency with processing.

The Trend Toward Auto-Adjudication in Claims Processing

Payers and Providers have incrementally added automation technologies to their claims processing as they have explored what digital transformation (DX) means for their businesses. This automation trend brings benefits to the adjudication process both upstream with data validation and downstream with document routing. Automation has the potential to improve nearly every administrative process in healthcare, but especially to increase auto-adjudication rates.

Challenges Against Electronic Claims Processing

Fully automated claims processing is unrealistic in today’s world for a few reasons, but IT teams that plan for incremental efficiency over time have greater success moving toward automation as a whole. Barriers against complete automation include a lack of standardization in processes and disparate systems needing to work together. These challenges are being addressed through mandates such as the No Surprises Act (NSA) and General Data Protection Regulation (GDPR), two regulations that require advanced technology for compliance.

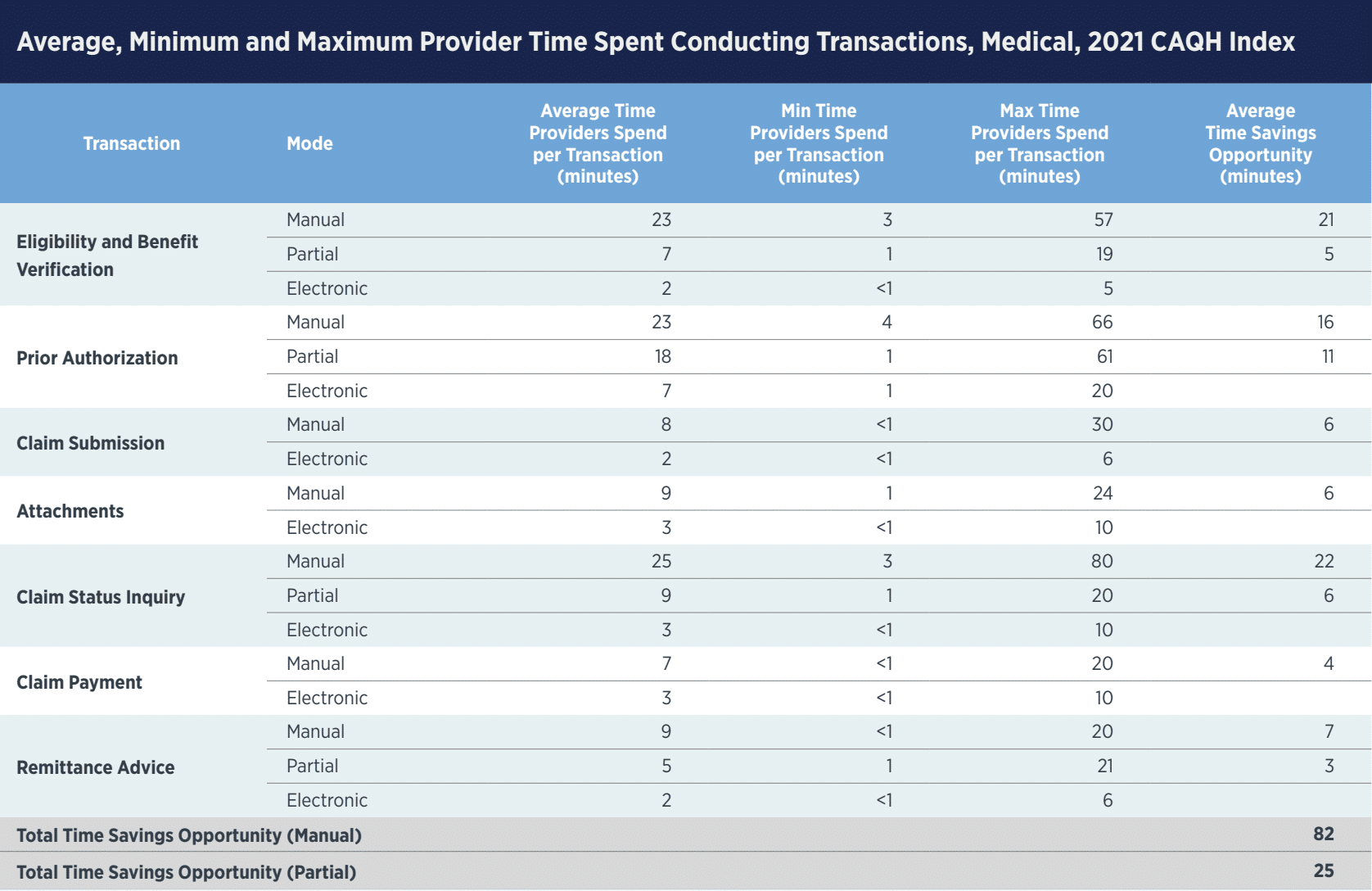

The CAQH Index started measuring portions of electronic healthcare processing in 2017 with an annual study that brings transparency into where most Providers and Dental Practices are with their digital adoption. The 2021 Index reported that fully electronic claims processing has a 76% adoption rate among medical plans, while electronic remittance advice is at 64%. Both of these areas have steadily increased electronic adoption since the study started.

Partnering with a healthcare IT provider can bridge the gap between Payers and Providers to bring automation to any claims processing workflow.

5 Steps Every Healthcare Claims Adjudication Process Follows

Even though Payers and Providers work with different systems, the healthcare claims adjudication process remains the same:

- The claim is submitted.

- A basic information check is performed (correct plan ID number, no duplicate claims).

- A detailed information check is performed (diagnosis and procedure codes).

- A decision is made: paid, reduced, denied.

- An Explanation of Benefits (EOB) for how the Payer came to that decision is sent to the Patient.

How to Improve the Adjudication Process

The CAQH Index states,

“…of the $391 billion spent on administrative complexity in the United States healthcare system, $42 billion, or 11 percent, is spent conducting administrative transactions tracked by the CAQH Index. Of the $42 billion, the industry can save $20 billion, or 48 percent of existing annual spend, by transitioning to fully electronic transactions.”

Payers and Providers could save nearly half of their annual spend on claims processing by adopting automated systems. Fully electronic processing is a stretch goal, but adding intelligent automation over time is a realistic step forward for most companies.

Current methods of manual claims processing prevent companies from growing. Challenges of manual processing include slower turnaround time, higher overhead costs, and a greater potential for human error. In fact, the majority of medical billing errors begin upstream with inaccurate or incomplete data.

The best place to start with improving the adjudication process is to apply intelligent automation upstream to validate data before a claim is adjudicated. Payers and Providers can easily achieve this by bringing in an IT partner that specializes in healthcare to help define the most impactful portions of workflows to automate, as well as provide the technical expertise to bring the strategy to life.

6 Benefits of Automating Claim Adjudication

Adding automation to claim adjudication puts Payers and Providers in an advantageous position because of several benefits:

-

Faster Claims Processing

The biggest benefit automation brings to claims processing is reducing the time spent manually processing each claim. When adding up potential savings across medical transactions, Providers can save a total of 82 minutes per claim over the lifecycle of a transaction, getting paperwork back to Patients faster.

-

Faster Payment Reconciliation

Receiving payments faster not only aids in accurate bookkeeping for Providers and Payers, but it also brings a competitive advantage that companies can pass along to their Patients. Fast, accurate communication is a differentiator in today’s medical, dental, and pharmacy industries. Adding automation to claims processing can help organizations communicate quickly about the status of a claim.

-

Less Manual Intervention

Humans make mistakes. While manual processing is essential for portions of claims workflows, data validation and entry isn’t one of them. Adding automated validation to claims processing reduces the accountability people have for accurate data entry, meaning fewer errors and higher success with processing rates.

-

Higher Data Accuracy

Increased accuracy helps tackle the biggest challenge against claims processing: inaccurate data upstream that result in denied claims. Machines excel at ensuring data is accurate and flagging inconsistencies that need further attention. This sets the foundation for claim processing at scale for growing companies.

-

More Time for Internal Resources

Employees no longer need to be responsible for mundane tasks such as data entry or validation. Instead, automation is used to perform repetitive tasks, while machine learning is used to alert employees of specific instances that need remediation. Teams can now focus on more engaging work and value-add tasks instead of status-quo operations.

-

Better Provider-Payer Relationships

Accuracy is the name of the game for today’s claims processing, closely followed by speed. Fast and accurate claims processing on behalf of both Providers and Payers helps build strong relationships among parties. Plus, the ability to customize outputs between disparate systems aids collaboration among partners.

Adding intelligent automation to claims adjudication is a strong starting point for optimizing legacy systems. Partnering with Smart Data Solutions provides the technical expertise to incrementally add automation as it makes sense to your business.

Automation in Action: Validation Checks in Claims Processing

Smart Data Solutions equips Payers and Providers with upfront validation checks that ensure the accuracy of claims to improve auto-adjudication rates downstream. We do this by performing several data checks, such as member matching, provider matching, SNIP Level Validation, and applying business rules and edits to workflows.

We also perform all the front-end edits, such as name parsing and validation checks. From there, it depends on specific business needs from our customers, but typically, we then route this documentation to its proper destination (such as PPOs for repricing) and, finally, send the claim back to the Payer so it can be adjudicated either manually or automatically on their end.

The specifics of how a healthcare IT partner can add automation to workflows vary from company to company, making dedicated healthcare expertise a must when optimizing current systems.

4 Questions to Ask When Researching Claim Adjudication Services

Gartner reports DX was top-of-mind for Payers and Providers in 2022. One of the fastest ways to transform IT architecture is to partner with a healthcare technology partner for industry and solution expertise. Healthcare IT partners review current systems to help internal teams determine the best ways to optimize processes.

When evaluating potential vendors to help modernize claim adjudication services, consider asking the following questions to prepare for a successful partnership:

- Does this vendor specialize in the healthcare and medical industries?

- Does their team provide strategy and direction, implementation and execution, or all of the above?

- How do they approach technology innovation in-house?

- Can they expand on their process for optimizing claim workflows?

Finding a partner with healthcare-specific expertise who proactively advises on ways to enhance administrative processes is key to adding automation to everyday operations.

Beyond Medical and into Pharmacy and Dental Claims

Pharmacy and dental claims are closely related to medical claims processing. They go through the same steps with adjudication to assess the claim’s accuracy and validity before continuing to process the claim.

The biggest difference is that pharmacy claims often go through prior authorization, which can increase the complexity of the claim and the time it takes for processing. Adding automation to process claims and attachments quicker brings efficiency to prior authorizations for pharmacy claims.

Expedite Claim Adjudication by Partnering with Smart Data Solutions

Healthcare experience, technology expertise, and a proactive approach are the qualities that make a strong healthcare technology partner. Smart Data Solutions brings 20+ years of healthcare experience and is HITRUST certified.

Make digital transformation a reality for your business by contacting our technologists for a consultation.