You might have heard, “If it’s not broken, don’t fix it.” But we’re countering that with, “Unless you can save $2.5 billion.” Paper EOP to 835 conversion seems like a complex topic, but this article will break it down so you can see how it affects your day-to-day revenue cycle management.

Converting EOPs to 835s increases the accuracy and speed of payment reconciliation. Ultimately as the workflow for revenue cycle management becomes more electronic, patients and providers benefit from proper billing and processing.

Helpful Terminology for Paper EOP to 835 Conversion

- Explanation of Payments (EOP) – A paper explanation generated by the insurance payer post-adjudication showing an overview of what was paid for the services rendered.

- Electronic Remittance Advice (ERA) – The process of a payer determining appropriate payment amounts and documenting it electronically.

- 835 – A tidy electronic file of the EOP that documents remittance advice.

- 837 – A claim file.

- Revenue Cycle Management (RCM) – “…the financial process that facilities use to manage the administrative and clinical functions associated with claims processing, payment, and revenue generation,” according to Revcycle Intelligence.

One of the barriers to achieving seamless claim payment reconciliation is the provider’s inability to process a payer’s paper EOPs. This happens because payers are electronically enabled while lacking the ability to capture EOP data electronically. This small misalignment can have a butterfly effect of potentially avoidable errors down the road including processing delays and data entry mistakes.

The Tiny Gap In Current EOP Processing

No single source of truth exists for the best RCM. It’s up to each payer and provider to create a workflow that best suits their businesses. Paper will always be part of medical billing to some extent, however, we can say with certainty that electronic enablement will always optimize workflows with faster processing and a better experience for patients and providers.

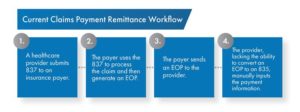

The below scenario is an example of a common workflow for claims payment remittance that highlights the gap between providers and payers:

The gap here is obvious, but what may not be clear is that the solution is extremely simple. Electronic enablement with EDI allows providers to capture 835 data and process it electronically. Electronic data capture is available to nearly every provider because the barrier to entry for these services is much more manageable with today’s flexibility from third-party administrators.

4 Ways Electronically Enabling EOP to 835 Conversion Affects RCM

The main challenge with paper EOPs is that they have the potential to complicate downstream processes. This leads to issues such as high volumes of paper, room for human error, expensive labor costs, and longer processing times.

Conversely, EOP to 835 empowers providers with electronic reconciliation of EOPs. The benefits of data capture solutions used in this process include faster turnaround time and validation checks to catch errors. Individuals who have a stake in the company’s RCM can rest easy knowing the accuracy of an automated system will reconcile all payments with no open ends or confusion.

The below scenarios show tangible ways EOP to 835 conversion affects RCM.

1. Cut Remittance Advice Processing Times by 75%

The average time to process remittance advice manually is eight minutes, according to the 2020 CAQH Index Report. This time is cut down to two minutes when processing remittance advice electronically. Multiply that six minutes of saved time by the number of 835s your practice receives every day, and the efficiency of EOP to 835 becomes apparent.

2. Lower Paper Volume Decreases The Room For Error

More paper to deal with means more hands on deck for processing. Not only is this costly from a labor standpoint, but it also increases the room for error when manually entering data. Humans aren’t perfect, but SDS’s data capture technology used in EDI has a 99.5% accuracy. Electronic enablement optimizes your RCM with labor reallocation and more accurate billing.

3. Fewer Roadblocks with More Transparency Of Historical Transactions

The beauty of a clean 835 is the ease at which providers and payers alike can look up historical transactions. Say for example, the 835 needs to be reconciled against an 837, requiring an 837 transaction history for accurate processing. While this adds another step for manual claim payment remittance, it can be done automatically through AI when working with a clearinghouse.

4. Higher Cost Savings Potential with ERA

Of the $6 billion the medical industry spends annually on remittance advice transactions, providers could collectively save $2.5 billion by switching to ERA, according to the CAQH report. This is the second-highest opportunity for savings potential, just behind eligibility and benefit verification.

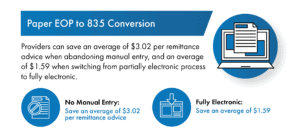

The report shows that providers can save an average of $3.02 per remittance advice when abandoning manual entry, and an average of $1.59 when switching from a partially electronic process to fully electronic. Consider these cost savings in light of the number of 835s your practice processes in a given week.

Jumpstart Your Paper EOP to 835 Conversion

You may think you’re stuck with current RCM processes, but this is not the case. The flexibility offered with today’s healthcare business process outsourcing means companies like SDS can plug into your current process and identify tangible ways to optimize it.

Oftentimes this starts with clearinghouse services such as EDI. Current capture and mapping methodologies allow us to create 835s so your operation feels entirely electronic. This puts your practice in the realm of faster processing, more accuracy, and better revenue integrity—everything that comes with embracing an electronic system.

The one requirement in your search for a partner is to make sure they are capable of moving large amounts of data for payers and providers in clean 835s. Get started with a free consultation on the best way for your organization to approach EOP to 835. Contact us here.