The New Year has passed and the deadline for complying with the No Surprises Act (NSA) is in effect. This means insurance Payers and healthcare Providers will need to work together to negotiate payment rates and cover the cost for specific patient care situations.

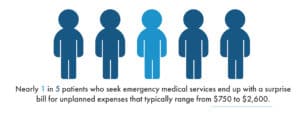

Introduced in 2020, the No Surprises Act is aimed at preventing consumers from unexpected medical expenses. A report from the US Department of Health and Human Services Office concluded that nearly one in five patients who seek emergency medical services end up with a surprise bill for unplanned expenses that typically range from $750 to $2,600. This summary of the NSA gives an in-depth overview for more detail.

With the deadline passed, insurance Payers and healthcare Providers have needed to rework their internal processes for compliance. Paramount to revamping these workflows is the technology, expertise, and automation that supports them—three factors that Smart Data Solutions (SDS) brings to every partnership.

Whether administrative teams need support with advancing automation, or a streamlined lift and shift effort to meet compliance, partnering with an industry expert such as SDS is a sure way to ease the transition of NSA regulations.

The Role of Balance and Surprise Billing in the No Surprises Act

The No Surprises Act is aimed at helping patients avoid expenses for specific medical situations. These situations fall into three categories, the first of which is emergency medical services, including services rendered while in a hospital, as well as transportation services if the patient is transported via an air ambulance. Ground ambulance transportation is not covered under the No Surprises Act.

The NSA also includes post-emergency stabilization services, meaning care that still falls within the emergency visit until a doctor can clear the patient to travel to an in-network facility.

The last situation the NSA covers is non-emergency services that are provided at an in-network facility, but by an out-of-network physician. It’s common for physicians to work at a facility but bill independently. This means they don’t always participate in the same health plan networks the facility does.

Remember that the #1 goal of the NSA is helping consumers avoid unexpected healthcare expenses. In the healthcare industry, these unexpected expenses are often the result of one of the above scenarios and come in the form of balance billing or surprise billing.

- Balance Billing occurs when a patient unknowingly receives care from an out-of-network Provider and has no meaningful choice in deciding care options. This is often the result of emergency medical services or medical care performed at an in-network facility, but by an out-of-network physician. Historically, these surprise bills would be passed along to the consumer, but the new NSA rule puts the burden of responsibility on insurance Payers and healthcare Providers to negotiate the payment amount and bear responsibility for covering it.

- Surprise Billing is the outcome of balance billing. Once balance billing is determined, then the bill is passed to the consumer as a surprise bill to pay for an out-of-network service charge.

Balance billing and surprise billing are concerns even for patients with private insurance. The federal government estimates 18% of emergency medical visits from privately insured individuals still result in at least one out-of-network claim, according to KFF.org. Introducing the No Surprises Act was a radical approach to changing this situation.

The new rule puts the administrative responsibility on insurance Payers to determine what is or is not a surprise bill, negotiate with healthcare Providers to agree on a payment rate, and cover the cost of balance billing instead of passing it on to the consumer as a surprise bill.

How to Determine the Qualified Payment Amount (QPA)?

How do insurance Payers determine the Qualified Payment Amount for services rendered?

The QPA is the median in-network contracted rate for similar services in a geographic region for the previous year, inflated by the Consumer Price Index for All Urban Consumers. This calculation is cumbersome to determine. Plus, we’ve noticed different entities are determining their QPA calculations differently, which is to be expected as organizations work through their approach to compliance.

Under the No Surprises Act, insurance Payers become the primary responsible party to determine QPA amounts. Fortunately, partnering with Smart Data Solutions means you get help with calculating QPAs at scale. SDS assists insurance Payers in processing claims by determining the QPA and passing the amount either in reporting or in an 837 segment. Our technology customizes workflows to provide information in any format needed regardless of the type of file or structure.

Equip Claims Workflows for Compliance with the No Surprises Act

Insurance Payers and healthcare Providers will need to learn to navigate changes to their workflows in order to comply with the NSA. While these updates are tricky, they are much easier with technology on your side.

Our team at Smart Data Solutions has been preparing to help our clients for compliance with the No Surprises Act since it was announced. We’re offering a free consultation with certified technologists to determine how the No Surprises Act affects your business.

We advise on short-term steps for immediate value, as well as strategic roadmaps for ongoing optimization of claims workflows. Request a consultation today and see how having an industry partner in your court takes the stress out of changes brought on by the No Surprises Act. Request a Consultation Here.